Few business leaders or entrepreneurs in American history have done more to enable progress and prosperity than Samuel Insull, a name little known today. Yet eighty years ago, he was one of the most famous people in America and Europe—and one of the most despised. Starting with nothing, the entrepreneurial Insull became one of the most intelligent and skilled entrepreneurs we have studied. He did more to bring electricity to America than any person outside its inventors. Sam Insull put together an energy empire worth billions, only to see it disappear from his grasp in the Great Depression. What happened then is one of the great tragedies of business history. Here is the story of this misunderstood and unsung hero of the electrification of America.

Beginnings

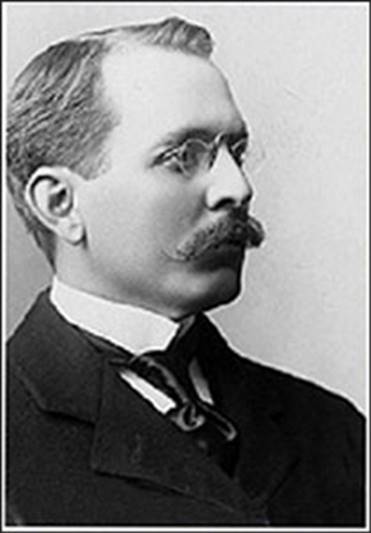

Samuel Insull, the second of five children who lived to adulthood, was born in London on November 11, 1859. His father was more interested in crusading for religion and temperance than he was in making a living. His mother was more practical. While young Sam learned toughness from his mother, he got imagination and enthusiasm from his father.

When William Gladstone served as prime minister for the first of four terms, from 1866 to 1874, the temperance movement rose to prominence. This resulted in Sam’s father becoming a paid secretary of the movement in Oxfordshire. For eight years, the family could afford to send their sons to a private school in Oxford, where Sam and his two brothers were tutored by Oxford students.

Sam Insull demonstrated lifelong attributes that would serve him well, even as a youth. His biographer, historian Forrest McDonald, states that “[Sam] was small, but his physical endurance was boundless and his energy was inexhaustible . . . . He invariably awoke early, abruptly, completely, bursting with energy; yet he gained momentum as the day wore on, and long into the night.” Only late in life did he learn how to relax; it did not come easily.

Throughout his life, Insull was a sponge for knowledge. He preferred the concrete to the abstract, the practical to the ideological. Sam excelled in math and loved history, political economy, and the classics. He was inspired by Samuel Smiles’s book The Lives of the Great Engineers.

Early in life Sam Insull “learned to see to the heart of relations between things, or between men and things, or between men and men, and to grasp the underlying principles so clearly that he could perceive ways to shift them around a bit and make them work the better.”

These skills came in handy when Gladstone’s first ministry ended and Sam’s father lost his job. The family moved back to London, hoping that the father and Sam’s older brother could find work. His father hoped that fourteen-year-old Sam would study to become a minister. But Sam was convinced that before a man could pray, he had to eat, and with the support of his mother, he searched for a job. Relenting, his father lined up a job for Sam at his friend Thomas Cook’s tourist agency. The job would not be open for several months, and Sam’s father demanded Sam wait. The two argued. Sam stormed out and headed to the London Times office to study the help wanted ads. He found a job as an office boy at a firm of real estate auctioneers. It paid about $1.25 a week, less than the cost of daily railway fare and lunch, so Sam walked to work and skipped lunch.

Thus, in July of 1874, the fourteen-year-old started this first job—he was never to retire until forced out of his job fifty-eight years later, and even then, he had new plans and ideas. Sam spent the next four and a half years at the auction firm, absorbing the world of business, especially real estate.

When a more senior clerk told Insull his handwriting was awful, Sam quickly learned to make it better. Impressed, the clerk started teaching Sam shorthand, which Sam studied and practiced every night. Soon he was an expert stenographer, picking up outside jobs and doing them in the evenings. This led to a more permanent “part-time” job. From 1877 to 1879, Sam spent four evenings a week, from eight to midnight, taking dictation for Thomas Bowles, the editor of the magazine Vanity Fair. He learned the power of the printed word and the vagaries of political intrigue from the man.

Sam’s curiosity never slowed. He read everything he could get his hands on. With multiple jobs, he only had time while riding on trains (he could afford them now) or while walking. He did not have time to take notes, so he developed the skill of memorizing virtually everything he read.

Yet he still squeezed in time for the theater, opera, cycling, and a literary society. As secretary of the literary society, he invited PT Barnum to speak and continued their friendship afterwards. Sam thereby learned more about marketing and promotion. Sam was then asked to speak to the group himself. Lacking time, he figured he could find an interesting article in an American magazine that his friends had not seen and talk about what he learned. Scribner’s Monthly had an article on a thirty-one-year-old American named Thomas Edison. Sam gave a successful talk on Edison, who seemed to be a man with ambition, a creative thinker, the kind of person who appealed to Sam. He started reading everything he could find about Edison.

In 1879, Sam, then nineteen, took a job as the secretary to an American banker who lived and worked in London, the world’s primary financial and stock market of the times. He had unknowingly stumbled upon the opportunity of a lifetime, as the man was also Thomas Edison’s representative in London. Sam dug in, studying every piece of paper that related to Edison, memorizing it all. By the fall of that year, when Edison’s top engineer, Edward Johnson, came to London to conduct business for Edison, Johnson found that Sam Insull knew more about Edison’s European interests than anyone else, including Edison himself.

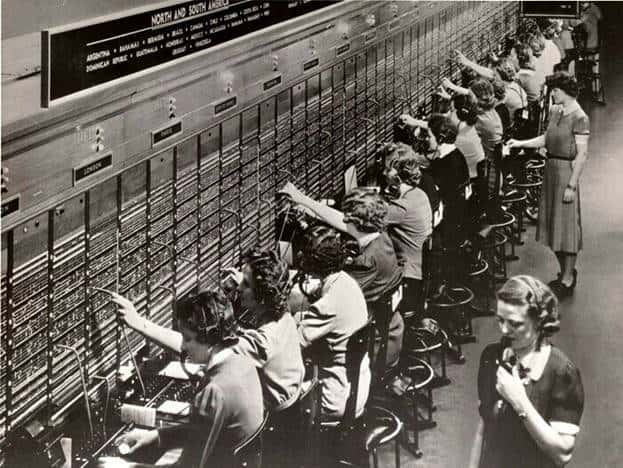

Sam spent every available minute talking to Johnson and Edison’s engineers, learning all the details of the technologies they were working on. He carried their pliers and strung wires for them. When Edison opened a telephone exchange in London, Sam was the first operator. (For those readers too young to remember telephone operators, they were the people, usually women, who answered the phone at the phone company and then switched your call to the right place using big plug-in switchboards.)

When engineer Johnson griped that Englishmen were lazy, unwilling to work on weekends, Sam volunteered to do Johnson’s secretarial work for free, at Johnson’s residence any time he was needed.

On the other side of the Atlantic, the eccentric Edison was busily experimenting and inventing. Outside of his current invention obsession, he was not good at details, organization, or “follow-up.” His personal and business affairs were chaotic. Johnson soon realized that Samuel Insull would make an ideal assistant for Edison if the right opportunity arose.

By this time, twenty-year-old Sam was well known in financial and leadership circles in London. Sam turned down the chance to go into banking in New York for the big investment firm Drexel Morgan when their London man offered him the job. Sam idolized Edison and only wanted to work for him. Finally, after Johnson returned to the States from his London assignment, he began to drop hints to Edison about Insull.

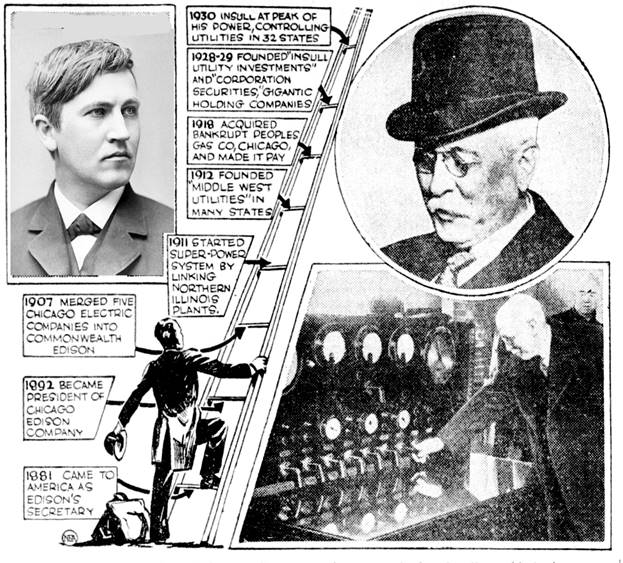

In January 1881, Edison’s private secretary quit (Edison was not an easy man to work for). Johnson wired Insull to come to America right away, without any further information on what the job would be or how much it would pay. (Sam’s income had risen dramatically in London, to 400 pounds a year.) Sam’s friends and relatives thought him reckless to quit his job and cross the ocean based on so little information, working for some crazy inventor who was not yet world-renowned. But Sam knew better. His mother only made him make one promise: that he would never touch alcohol, a promise he kept until the day he died.

Crossing to the New World

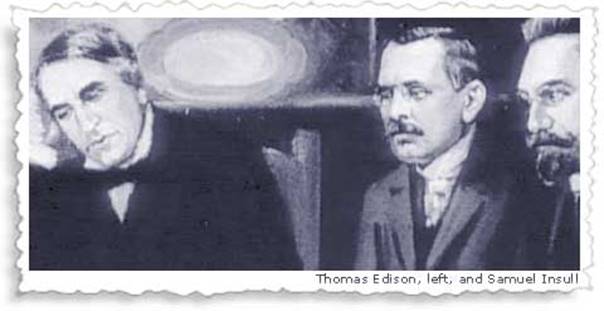

At dusk on February 28, 1881, twenty-one-year-old Samuel Insull landed in New York, setting foot in the United States for the first time. He looked forward to his friend Johnson smoothing the way for him, introducing him to the other workers, and serving as his mentor. Johnson did meet him at the dock, but Sam’s heart sank when Johnson said he was leaving for London at five the next morning and would not be around to help Sam acclimate.

The two dashed to Edison’s Manhattan office, where Edison was shocked at how young Sam was (at twenty-one, he was skinny and looked sixteen). Edison, at thirty-four, also seemed young to Insull. In many ways, the two men were worlds apart. Edison had trouble understanding Sam’s thick Cockney accent. Sam had equal difficulty understanding Edison’s Midwestern accent. Sam, as always, was impeccably dressed and as formal as the Victorian age from which he came. Edison did not care much about clothing, how he looked, or whether he shaved; he could not have been more informal. With his mentor Johnson leaving town, things did not look good for Sam Insull.

Johnson then showed Sam his shared upstairs sleeping quarters above the office, took him to dinner to meet Mrs. Edison and Mrs. Johnson, and then by eight o’clock that evening back to Edison’s office.

Thomas Edison was hell-bent on commercializing electric service, starting with a small area of downtown Manhattan. But his investors, including the all-powerful JP Morgan, refused to put up more money for his insane ideas, so Edison was prepared to sell anything he owned to finance the project. First on the block were his interests in European telephone securities. Johnson was leaving for Europe in nine hours to sell the shares. Edison and Johnson grilled Insull: What was the best way to sell the stock? Where should it be sold? How much was it worth?

Insull resoundingly answered all their questions, going over documents all night. At four the next morning, Insull took Johnson to catch his 5 a.m. sailing, armed with a complete understanding of the task ahead. From that moment forward, Samuel Insull was Edison’s top finance man and business executive. After a couple of hours of sleep, Sam was back at work at the Edison office. Edison asked him how much pay he wanted; Sam answered, “Whatever suits you.” Edison then started him at one hundred dollars a month.

Thomas Edison’s financial affairs were a mess, and his challenges and obstacles were immense. These problems were Samuel Insull’s great opportunity. Investors would not invest more funds, but Edison’s concept of “central station” electricity required substantial capital. It was far easier to sell businesses (and investors) on the idea of “isolated plants”—a separate power plant and generator in each office building or store, serving just that building. On the other hand, the central station idea, providing juice to an enormous area—up to a mile from the central station—required tearing up streets, laying copper wires, rewiring buildings, and generating the electricity itself in a larger power plant.

The entire system, all the parts from light switches to bulb sockets to wiring, had to be invented, had to be tested, had to be manufactured, and hardest of all, had to be sold. Capital was difficult to find, and when Edison got some, it was quickly spent. (Insull later said, “We never made a dollar until we got the factory 180 miles away from Mr. Edison.”) Someone had to take on and organize all these tasks. The man making it all work, rationalizing and integrating Edison’s efforts, was Sam Insull.

Every bit of Sam’s tireless energy was required. At the same time he carried all those “executive” burdens, he continued as Edison’s personal lackey. He answered Edison’s mail, bought his clothes, wrote his checks, fetched his umbrella, woke him up from his frequent naps—whatever it took to get the job done, to make progress. Thomas Edison soon realized that few men were as loyal to him as Sam, few were willing to obliterate anything or anyone in Edison’s way like Sam was, that Sam worked even harder and longer than Edison did, and that Sam did it all with incredible speed, organization, and efficiency.

Samuel Insull continued in these roles for the next eleven years.

Creating the Central Station Industry

One of Sam’s first big assignments was to sell the idea of central stations across America. As he traveled to cities large and small from coast to coast, he found three major obstacles. First, those willing to try electricity like big stores and office buildings had adopted the more popular and less expensive isolated plants. Next, to get the rights to build a central station and wire an area required a “franchise” from the city, which often involved corrupt politicians. Third, people used gas for lighting, which was cheaper, already established, but gave off a variable, harsh light—and if the city used gas, the gas company had already bought the politicians.

So it seemed an impossible struggle, and that was even before he convinced locals to invest the money in a new central station. But Sam was an exceptional salesman, and soon he had sold almost thirty systems. It was said that “his eyes could persuade, command, demand, or hypnotize.” In order to get sales and build plants, the Edison company often took stock in the new electric companies as partial payment for the equipment they bought from Edison’s factories.

This experience broadened Sam’s education even further. By the age of twenty-five, he knew most of the important investors and politicians on both sides of the Atlantic; he understood every nook and cranny of America; and he understood local politics, competition, finance, marketing, and technology.

As his income rose, he brought his two brothers and his older sister to America. He sent his younger brother, Martin, to Cornell for a degree in electrical engineering, which was helpful in Sam’s later ventures. Sam continued to self-educate, reading John Stuart Mill and Charles Dickens on his long train trips around America. He became a “marvelous” writer of letters. He discovered that when he was surprised by something, his upper lip curled upward, making him appear angry, so he grew a mustache that he wore for the rest of his life.

The years 1885 and 1886 brought two developments that dramatically increased the demand for central stations.

First, the electric streetcar system was perfected; by 1889, 154 systems were in operation in the United States. These operations required massive amounts of power, which for many years exceeded the demand for business and residential power. Since electricity cannot be easily stored, it must be “manufactured” at the same instant it is used. A resulting challenge for the industry was spreading the load: getting people to use electricity at various times of the day, in order to fully utilize the huge investment in generating plants and the even-more-expensive wires and cables. Lighting was used at night in homes and midday in offices. Streetcars used the most power during rush hours, when the demand for homes and offices was lower. So the rise of streetcars was a big plus for the industry.

The second development was the perfection of AC (alternating current) electricity by George Westinghouse, Nikola Tesla, and others, all of whom Sam knew. DC (direct current) power like Edison used could only be economically transmitted about a mile from the central station, whereas AC could be transmitted hundreds of miles. Streetcars and AC led to a boom in central stations, though isolated plants and gas continued to be competitive.

Insull came to believe in AC, but Edison’s ego would not allow him to approve of it. Edison went to great lengths to prove that AC was dangerous (which it was not if installed and used correctly). He even electrocuted animals with AC to demonstrate its evils. When the first prison electric chair used AC power, Edison said the executed man was “Westinghoused.” The complete story of the “current war” is told in this book and this film.

As the sales of central stations and equipment boomed, Edison needed to expand his manufacturing companies. Sam found an abandoned locomotive factory in Schenectady, New York, and moved Edison’s electrical equipment factories there. Edison put Insull in charge, telling him to “Do it big, Sammy. Big success or big failure.” The upstate New York city then became the hub of innovation and production in the electricity industry under Sam’s organized leadership. In the first two years, Sam set up one of the earliest national sales organizations and quadrupled the company’s sales. Over the six years that Insull ran manufacturing and selling for Edison, the number of workers in Schenectady grew from two hundred to six thousand. Profits boomed and the value of the company grew six-fold.

Despite this growth—or due to it—the company was always short of cash. Every penny of profit went back into expansion and research, a policy Insull continued to practice the rest of his life. As the finance man, Sam spent enormous amounts of time raising money and dealing with bankers, including JP Morgan, whom neither he nor Edison were fond of. He hated the work, thought it nerve-racking and disgusting, but he did whatever it took to grow the business.

Edison General Electric

These financial dealings led to the creation of the Edison General Electric Company in 1889. This restructuring resulted in the merger of several of Edison’s companies, new cash invested in the company, and new cash in Edison’s pocket.

Learning to manage a large operation, Sam soon discovered the importance of treating workers with respect and paying them more than competitors for their talent. He did this not out of generosity, but because it made the factory run smoother, with few if any labor problems.

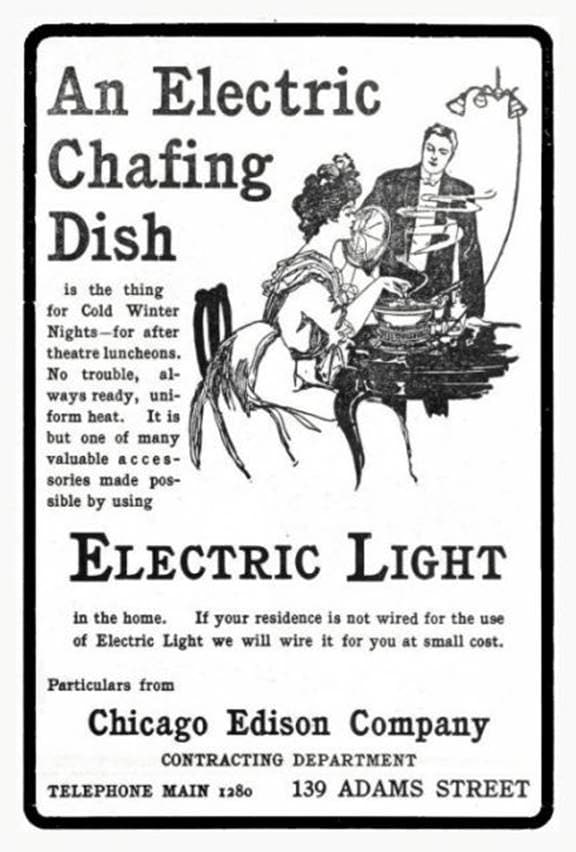

Another practice that Insull developed and used the rest of his life was the lowering of prices in order to increase production and lower costs. While many thought that electric lighting would only become a luxury for the rich, Insull and Edison proclaimed they could make it so cheap that “only the rich would be able to afford to burn candles.” Under Insull, the price of “lamps” (what we today call light bulbs) dropped from $1.00 in 1886 to $.50 in 1890.

As Edison General Electric grew, it had plenty of competitors. George Westinghouse was a great leader and innovator and a fair and honest man. Less becoming were the actions of the Thomson-Houston company of Lynn, Massachusetts. Led by the aggressive Charles Coffin, Thomson-Houston did not invest in research and trampled on the patents of Edison and others. Despite the company’s shortcomings, Thomson-Houston sold a lot of central stations and isolated plants and was a thorn in Edison General Electric’s side.

Under Insull’s management, Edison General Electric went from making a profit of $700,000 to $2 million two years later, with sales rising to $11 million. At that point, Thomson-Houston was generating about $10 million in sales and Westinghouse $5 million. Nevertheless, due to rapid growth and financing their customers by taking stock instead of cash, Edison General Electric had $3.5 million in debt.

Observing this competitive fray were the New York money men. JP Morgan, the most powerful of them all, believed in consolidating industries, attempting monopoly—he would go on to form giants including US Steel and International Harvester. Holding a large block of stock in Edison’s companies, including many of Edison’s patent rights, he decided that the electrical industry needed to be consolidated. Other major investors also worked toward a big merger of the industry.

When the dust settled in the spring of 1892, Edison General Electric merged with Thomson-Houston. While Edison and Insull believed their company was worth more than Thomson-Houston, the end result was that the owners of Thomson-Houston got more of the stock of the new company than the Edison stockholders got. Thus, Thomson-Houston management, under Edison’s rival Charles Coffin, was in control of the new company, which was named General Electric (GE). Edison made money on the deal but was no longer in control and quickly lost interest.

Even in this difficult position, Morgan and Coffin realized how good Sam Insull was, and offered him a vice presidency at GE, at a salary of $36,000 a year (over a million dollars in 2020 money). He was the only Edison man offered an executive position with General Electric. But Sam thought he had earned the presidency of GE. He had little respect for Coffin. He helped in the transition of the Schenectady works to the new company, then quit. Thirty-two-year-old Sam began to look around for the next opportunity. He found a big one.

Moving to Chicago

In his exploration of America and the electric industry, Sam had noted two things. First, he came to believe that the big opportunity was not in manufacturing electrical equipment, but in operating central stations and delivering electricity to homes, streetcars, and businesses. Second, he had witnessed the fantastic growth of Chicago: from under three hundred thousand people in 1870 to over a million in 1890, making it one of the largest and fastest-growing cities in the world. Edison had told him, “You know this [Chicago] is one of the best cities in the world for our line of business.”

Chicago was not a very clean city though. Sam Insull had spent time at the old Sherman House Hotel in Chicago, where the guests would sit on the porch and bet on how many big rats they would see. But Chicago was a nexus of business activity, full of entrepreneurs, risk-takers, and innovators.

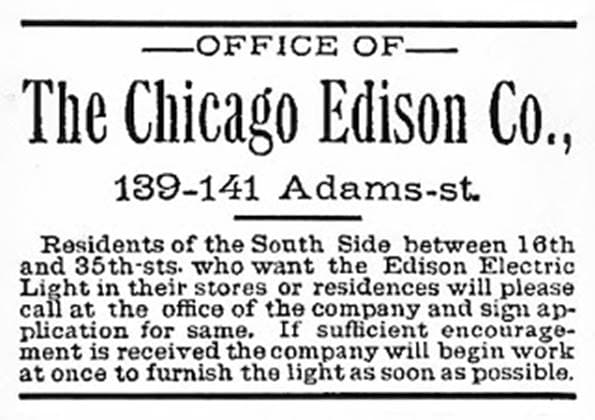

The Chicago Edison company was one of thirty local electric companies, each with limited rights (franchises). Chicago Edison served the downtown Chicago “loop” (named after the elevated tracks that run around the four edges of downtown). The Chicago Edison Board of Directors was seeking a new president at the same time that GE was being formed. They wrote Sam Insull, asking for recommendations, since he knew everyone in the industry. Perhaps they assumed he would not be a candidate, since he could have a big job paying $36,000 a year at a company (GE) capitalized at $50 million, whereas Chicago Edison only paid $12,000 at a company worth less than a million dollars.

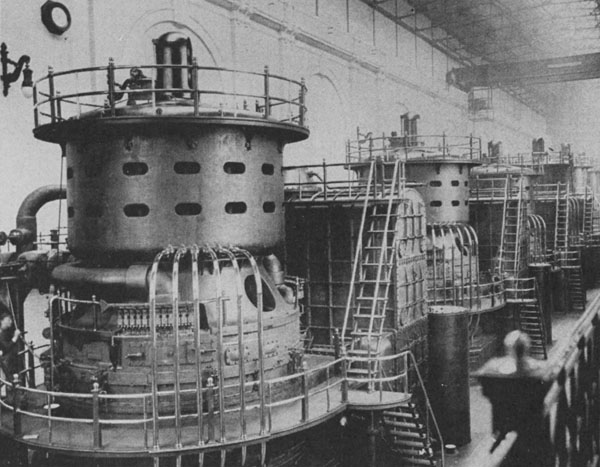

Sam Insull ended up taking the job in mid-1892 with two requirements: that he would have complete control and that he would not have to do any of the financing or raise money—that the board would take care of funding his ideas. And big ideas they were. Sam wanted to build the biggest power station in the world, using generators two to four times as big as any in existence.

Sam personally borrowed $250,000 from Chicago merchant Marshall Field in order to invest in Chicago Edison and finance that first big power plant. When it became fully operational in 1894, it was indeed the largest power plant in the world. In the ensuing years, Insull ordered larger and larger generators, always pressing GE to make machines they said could not be made. He said, “General Electric engineers carried slide rules with which they could prove anything was impossible.” Chicago Edison’s power output dwarfed the amount produced by the electric utilities in other big cities for the next forty years.

At the time, Chicago Edison served about five thousand customers. Most people thought that someday they might have twenty-five thousand (wealthy) customers. Sam Insull was intent on serving “the millions.” He immediately began to buy up the other Chicago electric utilities, absorbing their customers. Insull’s huge investment in his big power plant resulted in plenty of capacity beyond his current needs. By adding customers and service areas, he used more of the capacity of his plant, spread the capital investment over more kilowatts produced, and thereby lowered the cost of producing each kilowatt hour.

Sam also led the industry in innovation. He located the big plant on the Chicago River to use waterpower and save on the expense of coal fuel. He placed meters on each user’s line, an idea he discovered when back in England on a Christmas vacation. His biographer says that “he learned from everyone he met.” He also switched from Edison’s DC system to AC, and his engineers pioneered longer and longer power lines and distribution equipment, bringing electricity to far more people. Sam developed new types of financing and accounting for utilities. He introduced statistical studies to the industry, so he knew exactly when and where electricity was needed. Almost every Insull innovation gradually became common practice throughout the utility industry, as Sam shared everything he knew, founding and chairing the key national electrical associations.

While other utilities struggled, especially in hard times like the depression of 1893, Chicago Edison never missed its 8 percent dividend. After six years of Sam’s leadership and sixteen-hour workdays, the company was ten times as big as when he took over. Yet those same years, filled with a weak economy, also meant that credit and financing were hard to come by. Chicago Edison’s local board of directors were unable to provide the financing needed for Sam’s big ideas, so he was ultimately forced to get back into the money-raising game. He went to London and raised all the money required, amazing financial observers.

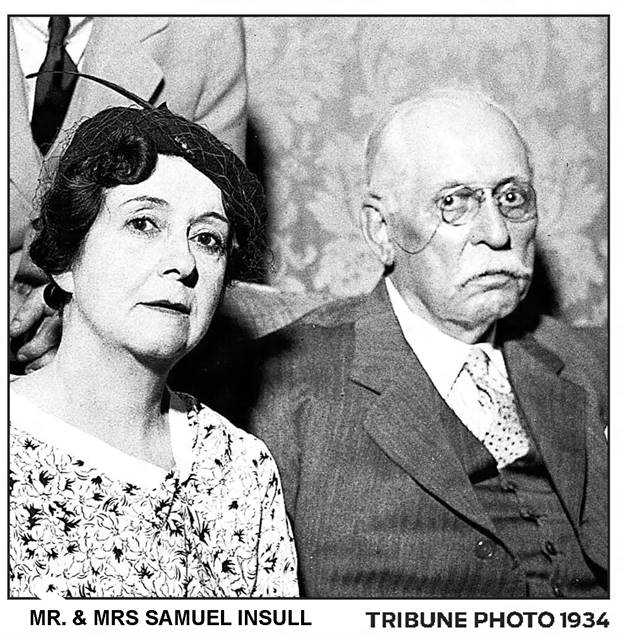

A new force entered Sam’s life when he met Gladys Wallis at a dinner party in 1897. The Irish-blooded actress, ten years younger than thirty-seven-year-old Sam, was petite (not quite five feet tall and under ninety pounds) and beautiful. Sam was smitten within a week and the two were engaged within a year. Gladys even turned down a $500 a week vaudeville offer (about the same salary as Sam’s), to marry Sam in 1899. In April of 1900, their only child, Samuel Insull, Jr., was born. The little boy would get early exposure to his mother’s love of poetry and the theater and his father’s love of trains, technology, and business.

Politics

It will surprise few to learn that Chicago has a history of political corruption, and that that corruption was especially flagrant in this era. Both city ward bosses and state officials switched allegiances with ease, riding the coattails of rising politicos and dropping them in a heartbeat. As a public utility, it was impossible for Sam to operate outside this mess.

When city “leaders” wanted to extort the city’s big gas company, People’s Gas, they created a new firm, owned by ten politicians and their friends, and gave it rights to operate broadly in the city. It had no operating business. They then promptly sold the virtually non-existent business to People’s Gas for $7.3 million in 1895 ($230 million in 2020 dollars).

Utilities franchises in Illinois were limited to twenty years, but then for a very brief period the state legislature was persuaded to allow terms up to fifty years. Seizing upon this window in order to extort Chicago Edison, Chicago’s controlling Republican machine created the Commonwealth Electric Company, giving it a broad (Cook) county-wide franchise with a fifty-year term. But Sam outsmarted them. He had bought enough companies that only he had rights to use the patents of General Electric and Westinghouse. Insull ended up buying Commonwealth Electric—and its extensive rights—for just $50,000.

While Sam never paid a cash bribe to the politicians (which could run up to $25,000 per vote), he had no choice but to play their games in order to survive and build his system. He donated generously to both parties. His biography is full of stories where he cut deals with them under the table, then Sam and his “opponents” went to the press and railed about the evils of each other, then a “settlement” was agreed upon, matching their original plan. Insull said, “We must expect public denunciations by one’s friends when political expediency demands it.” He understood that business demagoguery was one of the tools of the politician’s trade, one entirely unrelated to what they actually did in office.

The nightmare of dealing with each ward and each city around Illinois led Sam to promote the idea of an independent statewide utility commission to regulate the industry, including setting rates. It took a decade before states overcame local opposition and started adopting his ideas, which eventually swept the nation. Even after adoption of state commissions, opponents—both politicians who missed their bribes and “progressive” academics and politicians—called for “local control” and assailed the utility companies as being too powerful.

Sam Insull would battle politicians who put their own egos and interests ahead of the public for the rest of his days.

Bigger and Bigger

Insull kept building and building. He was using 4,000-kilowatt reciprocating steam engines, which had reached their maximum power. Anything bigger and their internal forces would pull them apart. He needed more powerful engines if he was to build the 50,000-kilowatt plant he wanted. Using the reciprocating engines would have required a power plant as large as the entire Chicago loop. He came to believe in the new idea of more compact steam turbines, which all the “experts” said would never work.

In 1902, he convinced GE’s Coffin to try steam turbines by threatening to find a supplier in England if GE would not work with him, and by sharing the cost of development with GE. This agreement took place despite Sam’s prior conflicts with Coffin; Insull did not hold grudges. Seventeen months later, the new 3,000-kilowatt turbine engine was ready to test. His chief engineer warned him to step away, as the machine might blow up. Sam said, “Well, if it blows up, I blow up with it anyway. I’ll stay.” As usual, it worked. Within a decade, his company was using 35,000-kilowatt engines and ten years after that, engines five times that size. Also as usual, his innovations were then copied throughout the electric utility industry.

Even as late at 1900, central stations produced less than one-thirtieth of the power used by America’s factories. The factories used gas, isolated plants, or water and other power sources. It was a tough sell, as the factories had to change over from belt-driven systems to electric motors. Gaslit shops and homes outnumbered those lit with electricity by twenty to one.

Even though Sam had made good progress in Chicago, he saw the national need for better electric systems. He began to organize electric utilities in the suburbs around Chicago, starting with the North Shore Electric Company. By 1911, he had expanded to over one hundred suburban communities, most of which had no electricity before Insull companies served them.

Sam Insull was one of the earliest people to understand the economies of scale involved in “mass production.” He told his salespeople, “Sell [electric service] so low that no one can afford not to have electrical service.” When he began in 1892, the price of electricity in Chicago was twenty cents per kilowatt hour. Five years later it cost a dime, and by 1909 two and one-half cents. Between 1898 and 1913, Sam’s customer list grew from ten thousand to two hundred thousand.

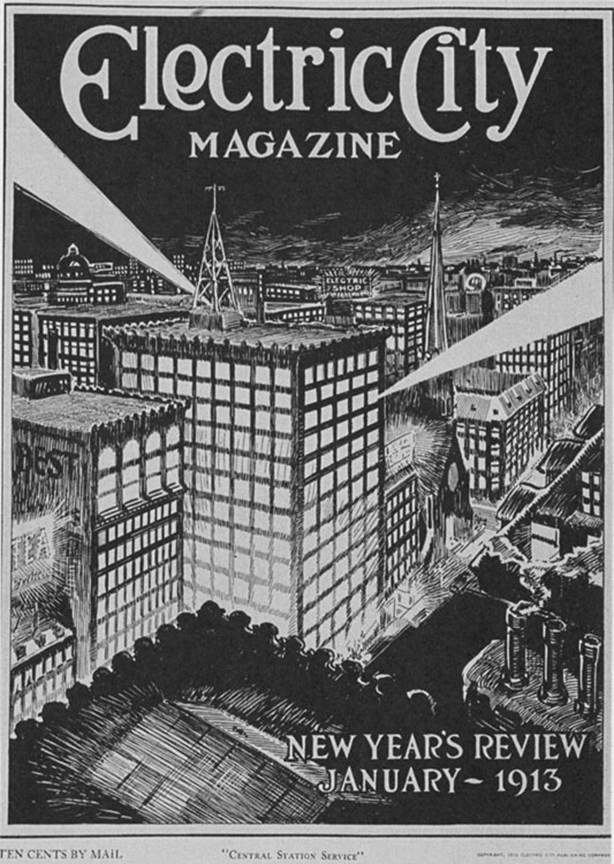

Given the importance of public perceptions of utilities—and the ongoing political challenges—Sam became a big believer in publicity and public relations. He trained his people in “PR” and told them that they represented the company wherever they went. Sam said, “You represent your company and your community. Be a credit to both.” In 1901, he started one of the industry’s first advertising departments. Chicago Edison produced a free magazine entitled Electric City, even providing newsdealers with electrically lit displays. Sam made speech after speech about all his ideas, from regulating the industry and employee benefits to the latest technologies and financing methods.

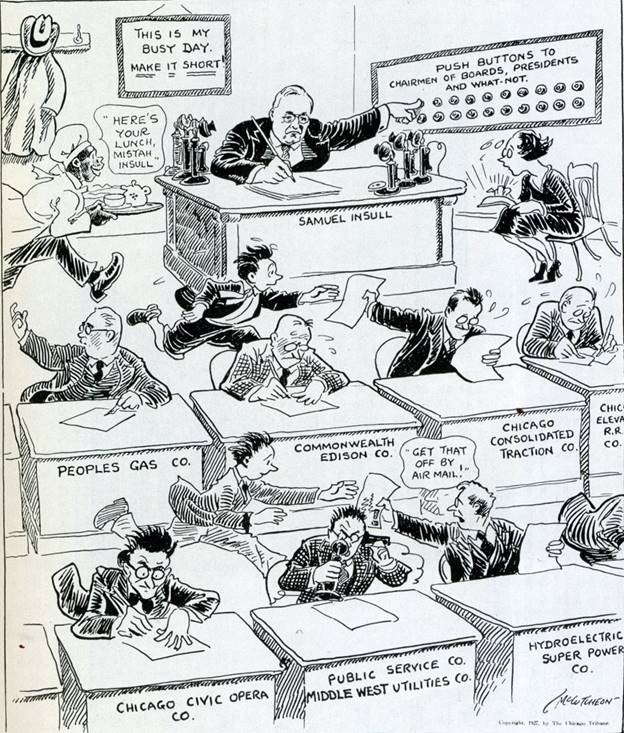

In 1907, he merged the loop-serving Chicago Edison with Commonwealth Electric, which served the entire county, forming the Commonwealth Edison Company. The company was capitalized at $45 million. By that year, Sam’s companies produced sixty times the electricity that they had when he arrived in 1892. By 1910, they produced more “juice” than the combined output of “industry giants” New York Edison, Brooklyn Edison, and Boston Edison.

Beyond Bigger

Insull also continued to show more respect for his workers than most employers of the time. As always, Sam paid intense attention to details, studying the employee benefits offered by the best companies and government agencies on both sides of the Atlantic. At Commonwealth Edison, he reduced the work week to forty-four hours when sixty or seventy was the norm. He offered free medical benefits, profit-sharing, company-sponsored night schools, unemployment compensation, savings and retirement plans, and sold his employees stock in the companies below market prices. The company later added free life insurance, employee cafeterias, and bought an elegant resort in Wisconsin, enabling his workers to enjoy inexpensive vacations. Employees with grievances could go to Sam’s open door (despite his fifty meetings a day) or to an independent board which could overrule management decisions. All employees were required to do community service. He made speeches to his fellow utility leaders, urging them to follow his lead.

Given his commitment to building a strong national electrical system, Sam Insull often helped utilities all over the United States, serving on their boards or doing consulting for them. He sometimes took stock as payment, resulting in small ownership positions from Pennsylvania to Louisiana to California. His reach was enormous: he knew every American president from McKinley to Hoover, though “all bored him except his friend Teddy Roosevelt.” By the time he was fifty, Samuel Insull was the undisputed leader of the American electric utility industry, and even helped design a national government-owned system for the United Kingdom.

Sam’s many activities brought him great wealth. He bought a yacht and a country estate near Libertyville, Illinois, where he built a mansion. The estate eventually covered four thousand acres and included the finest strain of the Suffolk draft horses, which he had loved as a child.

This rural adventure led him to expand his utility interests into rural Illinois. Again, “experts” said the idea of serving small, widely separated towns was foolish and could never prove profitable. The secretary of Agriculture in Washington dismissed his ideas. In 1911, he started the Public Service Company of Northern Illinois. Since no financiers believed in him, he had to finance this company with his own personal borrowing capacity. In its first four years, the company grew from 6,700 customers to over 65,000 in 150 communities; rates dropped almost in half. The company was profitable from the beginning. He then entered central Illinois, where he grew a company from 15,000 customers to 150,000, the number of towns served from 56 to 500, while rates dropped from fifteen cents a kilowatt hour to seven cents. Annual power production there rose from 15 million kilowatt hours to 400 million.

In the nineteenth century, all Sam’s efforts were focused on Chicago and Illinois with one exception. In 1902, he acquired small utilities around New Albany, Indiana, across the Ohio River from Louisville. He turned this operation over to his younger brother Martin, with his engineering degree from Cornell. Successful there, the brothers began to buy firms all over the Midwest, even including gas, water, ice, and streetcar companies. In 1914, they created the Middle West Utilities Company as a holding company for these interests. One of the small companies it owned was Texas-based Southland Ice, later renamed 7-Eleven, now the world’s largest retail chain by number of stores (about seventy thousand).

Between 1912 and 1917, the total assets of Insull companies ballooned from $90 million to $400 million, with operations in thirteen states. Everywhere they expanded, electric rates for rural customers were about half those charged in other parts of the United States.

Sam Insull held his key lieutenants to high standards. In order to ferret out “yes men,” he would sometimes take an absurd position, then see who would push back. That was a tough test for the men, who virtually worshiped Insull.

After about 1912, it is said he had no interest in accumulating more money but was focused on giving it away. While his income in the 1920s reached $500,000 per year, he often gave away more than that. He spent $50,000 a year on “pensioners,” people he wanted to live well in retirement. He was an easy touch for any employee, or even a stranger, who asked for help. He gave away thousands anonymously. Sam supported every major charitable effort in the Chicago area, ranging from a Chinese YMCA to helping African Americans and building new hospitals.

Gladys joined him in these philanthropic efforts. At the age of fifty-six, she still had her youthful beauty, successfully playing an eighteen-year-old in the play A School for Scandal. The play’s two-week run raised $137,000 for St Luke’s Hospital ($2 million in 2020 dollars).

Transit

By 1911, the passenger transportation system of Chicago was a mess. Numerous streetcar and elevated lines, Insull’s biggest customers, struggled to pacify riders and politicians despite being barely if at all profitable. The companies were unable to raise enough money to maintain or expand their systems. Under pressure from city leaders and with his sense of obligation to the city, Sam took control of all the elevated lines in 1914.

He assigned one of his brightest men, Britton Budd, to the project, who brought about reduced rates, universal transfers, clean stations, courteous conductors, and improved labor relations. Sam then acquired the two key Chicago high-speed interurban electric lines, the North Shore to Milwaukee in 1916 and the South Shore to South Bend in 1925 (which is today America’s sole remaining interurban). Sam developed a plan to integrate the many city streetcar lines with his elevateds and turn them over to municipal ownership. It took years of creative thinking and political finagling to bring these ideas to fruition.

At the same time he was engaged in that massive and difficult task, in 1913 city leaders asked him to become chairman of the deeply troubled, mismanaged, and almost bankrupt People’s Gas Company, his longtime competitor. Since Sam did not want Chicago to get a black eye if the company collapsed, he said yes. It would be a few years before he was forced to take a more active role in the company’s management.

Winning World War I

Even before the United States entered the First World War, Insull (understandably) supported Britain by helping Americans to sign up to fight for the British. When America declared war in the spring of 1917, he was selected to head the Illinois State Council of Defense. With so many Midwesterners of German descent, getting support for the war effort was a challenge. Due to his belief in publicity, Sam pulled out all the stops, setting up a speaker’s bureau full of people ready to talk about the war and its importance to America.

One-fourth of Commonwealth Edison’s employees entered the military during the war. The company continued to fund their families while they were in the service.

Contributing some of his best executives to the effort, Sam’s State Council organized 7,000 public meetings. By speaking at entertainment venues and movie theaters, the speakers promoted the war effort to 700,000 listeners a week. The idea was copied nationally, ultimately employing 75,000 volunteer speakers. In Illinois alone, the number of volunteers of all types reached 380,000. Two million people attended one battle re-enactment in Chicago. As a result of these efforts, residents of Illinois bought $1.8 billion worth of war bonds, double the national per capita average. Samuel Insull became known as “a miracle worker with a Midas touch” by the public. He received accolades and decorations from around the world for his wartime work. No one outside the government and the military was as revered.

Samuel Insull was now not only the “big man” of the global electric utility industry, he was also perhaps the “biggest man” in Chicago, a household name. Yet the man never had an unlisted telephone number, answering his own phone at his listed home phone number.

Moving into the Roaring Twenties

Dealing with rapid postwar price inflation, most utilities suffered financially. By 1919, ninety-one transportation utilities had collapsed. Every major electric, gas, and transportation utility except Commonwealth Edison requested (and got) rate increases. Yet “ComEd” never missed a dividend.

Insull’s companies never failed to meet the growing demand for power since he always built plants based on his statistically projected demand three years into the future. For example, between the start of the war and 1923, Middle West’s output mushroomed from 200 million kilowatt hours to almost a billion. But in the industry at large, service was worse and prices were higher, leading to public disfavor.

After the war, socialists and the powerful Hearst newspapers (including one in Chicago) attacked “war profiteers.” They then successively turned their muckraking “investigations” to international bankers, munitions manufacturers, and finally to public utilities.

Some of these utilities and their holding companies had been created, like many railroads before them, as a way for the organizers to get rich either by (1) setting up separate construction companies which overcharged the utilities or by (2) taking large financing fees on the initial capital raised. Once built, the organizers already had made their money and cared not about their ongoing success. Sam Insull never approved of these policies. He said, “If the rights of the public are properly taken care of in producing lower costs and in steadily improving service, the rights of the stockholders will take care of themselves.”

As part of his efforts to give his company and the industry a better public perception, he believed in educating people on utility economics. He learned that the large Pacific Gas & Electric Company in California was promoting the idea of customer ownership, which seemed an ideal way to get more people to understand his companies and support them.

Sam decided to sell preferred stock to as many employees (at a discount to market prices) and customers as possible. The vast majority of his employees became stockholders. Each of his companies set up a stock-selling operation and all employees were encouraged to sell stock to their friends and neighbors. The employees received commissions on whatever shares they sold. At the end of the war, Middle West had six thousand stockholders. By 1928, the number was almost 250,000. The value of the stocks and bonds rose and rose. In just the fifty days preceding August 23, 1929, Insull securities rose in value by $500 million. Sam’s own shares rose to a value of $150 million, an amount he had never dreamed of.

By 1930, Insull companies together had one million stockholders and bondholders. The “empire” had four million customers, properties worth $3 billion, and produced about one-eighth of all the electricity in the United States.

In 1913, Sam had agreed to become chairman of People’s Gas but was not hands-on until the troubled company was in desperate shape five years later. Upon investigation, he found that thirty-eight thousand customers had not even been billed, due to lazy meter-readers. While demand surged during the war, the company had no funds with which to expand capacity, and no credit with which to borrow money. Other Chicago leaders believed that turning around the company was an impossible task. But Sam inspired confidence. He cut his own pay in half. When People’s was unable to pay its taxes, Insull talked to his friends, and the county treasurer conveniently “forgot” People’s address for six months. He found sources of cheap gas by buying gas wasted at nearby steel mills. He met with wealthy Pittsburgh financier Andrew Mellon for three hours, convincing him to fund the $20 million required for plant expansion. People’s became profitable and started paying dividends. Between 1919 and 1929, the company’s stock rose from $29 a share to $400.

The stresses of the war, dealing with a sharp post-war recession in 1920–21, and dealing with People’s Gas took their toll on the usually energetic Sam Insull. In 1923, at the age of sixty-three, Sam had a nervous breakdown and badly needed rest. Sam and his son went to Europe, tramping around Scotland until he was fully re-energized.

Once back in the saddle, Sam Insull continued to expand his “empire,” buying out more utilities and placing them in his holding companies. More states were added to his already-long list of service areas, and hundreds of additional communities received electric service. The twenties did indeed roar for the Insull companies, with more customers, more employees, and more stockholders—at ever-higher stock prices.

The Attacks Begin

In 1929, Chicago’s transit system was still a mess, despite Sam’s efforts to make sense of it. At this point, he supported a plan to turn all the systems over to a “quasi-public” agency, with service provided at cost. The People’s Transit League was created to oppose the plan. This group was led by “progressive” intellectuals including University of Chicago professors Paul Douglas and Charles Merriam. But it was funded by bond dealers, afraid of losing their commissions on hundreds of millions of dollars of financing that a private company would need. (Bonds issued by a municipal agency would not generate such high commissions.) A major publicity fight ensued as the issue headed to a public vote (referendum) in Chicago in 1930. While the plan passed by 325,000 votes to 58,000, Sam now had some very vocal “enemies” who hated the idea of one wealthy man being so powerful and influential.

When Sam admitted to donating about $160,000 to a candidate for Senator from Illinois, his enemies falsely claimed that the amount was $500,000 and that a “$20 million utility deal” was involved and would benefit Insull. Headlines roared, “Big utilities buying elections.”

At the same time, the US Senate was filled with controversy over the construction and operation of Boulder Dam (later renamed Hoover Dam) and the control of power in the Tennessee River Valley. Some Senators, led by George Norris of Nebraska, argued for public ownership to avoid the “evil” big power companies.

Given the rising attacks on the utility industry, the Senate asked the Federal Trade Commission (FTC) to investigate the big utilities and utility holding companies. Sam Insull’s name was added to the list of people worth investigating. The FTC took seven years to finish their analysis, resulting in an eighty-four-volume report.

In early 1929, conservationist (and later Governor of Pennsylvania) Gifford Pinchot published a pamphlet entitled “The Power Monopoly—Its Make-up and Its Menace” in 1929. The widely circulated document was filled with factual errors about who controlled America’s largest utilities. Too many read it and believed it.

To further denigrate the utility industry, Senator Norris, leading the campaign for public control of power in the Tennessee Valley, claimed that America’s electric utilities were overcharging residential customers by $750 million per year. In fact, the industry’s total revenue from residences was only $650 million.

In June of 1931, American Ambassador Frederic Sackett was preparing to give a talk to the World Power Conference in Berlin. Insull received advance notice of the speech, which included the claim that electricity was sold for fifteen times its manufacturing cost, an outrageous profit margin. Of course that cost number did not include the much more massive cost of building power plants and laying wires. Insull met with Sackett prior to the speech and gave him a two-hour lesson in utility economics, after which Sackett decided not to give the speech. But news of the meeting leaked out, and again headlines blasted that “powerful businessmen are meddling in politics.”

New York Governor Franklin Delano Roosevelt hopped on the anti-utility bandwagon, though his pronouncements were inconsistent. At one point, he even opposed a plan by New York electric utilities to lower their rates. In his speeches, he railed against the utilities and holding companies.

The demonization of the electric utility industry accelerated, becoming “trial by newspaper.” Efforts by Insull and the industry to “clear their name” were increasingly seen as dishonest efforts, hiding their supposed shenanigans. Sam’s long-time rule, “Never answer the attacks of a politician,” was no longer sufficient to stay out of the fray.

The Crash

Just as the suspicion of utilities in general and Sam in particular were heating up, the stock market crashed in September and October of 1929.

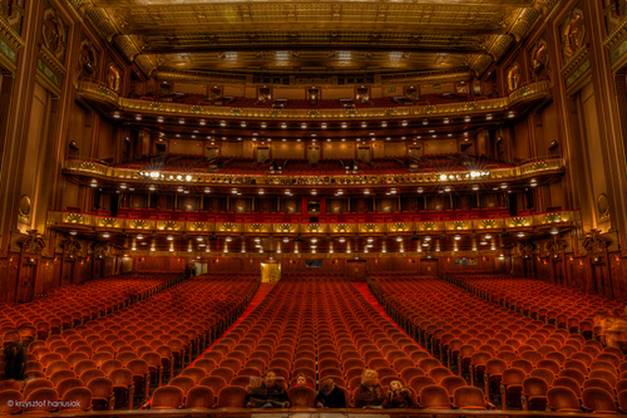

Shortly after the crash, Chicago’s outstanding new Lyric Opera House opened, a project Sam led and held close to his heart. The Opera was part of a large office building Insull had built. The Opera House itself did not please some Chicago elites: per Sam’s instructions and breaking with tradition, it had no fancy box seats at the front of the house, overlooking the stage. Sam wanted to serve opera to the masses, as he had done with electricity.

Like virtually every other business leader and most politicians, Sam had seen recessions before and believed this one would be brief. He used his personal collateral to cover all his employees’ margin calls (funds required to hold onto stocks when they drop in value if you have borrowed against them to buy more stock, which most investors did). He saved a long list of individuals and businesses from financial ruin. The city of Chicago was broke, so Insull put together over $50 million in financing to pay firemen, police, and teachers. Later during the Depression, his son organized one of the nation’s first statewide programs to help the poor and unemployed.

Despite the stock market collapse, Sam’s companies remained strong in the early days of the Great Depression. The value of the shares actually rose in 1930 and again through the first half of 1931. The companies invested $197 million in new facilities in 1930. They continued to issue new securities, which were over-subscribed and had to be rationed among buyers. With his usual optimism, Insull began construction of an $80 million pipeline to bring natural gas from Texas to Chicago.

In the midst of all this, Cleveland investor Cyrus Eaton had acquired a large block of stock in Insull’s companies, more shares than Sam himself owned. Some believed that Eaton was interested in wresting control from Sam. Insull’s Chicago banker friends urged him to borrow the money to buy out Eaton. They promised to provide the necessary $48 million. Four times Insull refused, not wanting to take on the debt. But on the fifth try, in 1930, he caved in, one of the few costly business mistakes in his long career. After agreeing to buy out Eaton, Sam found the Chicago banks changed their mind and would not fund the entire transaction, so he had to go to the New York bankers he had long disliked. The New Yorkers demanded Sam put up personal collateral far exceeding the $20 million amount of their loans.

The New York banks spread rumors about Sam—that he was dead or insane—in an effort to drive down the stock prices of Insull companies. As the Depression worsened, and stretched longer than most expected, the shares began to fall. In one week alone in September of 1931, the value of the companies dropped by $150 million. And as the shares fell, the bankers demanded more and more collateral from Insull, gradually acquiring voting control of his empire. The aging Insull did everything he could to avert disaster, cutting expenses and personally borrowing as much as he could. But it was futile.

The New Yorkers, led by JP Morgan, wanted to appear to be “white knights” saving the company rather than “evil” corporate raiders. They had their accountants delve deeply into the financial records of the Insull companies. Sam had years earlier pioneered innovative approaches to depreciation that were more fitting to utilities than the depreciation methods used by most companies. These innovations were then used by most of the electric utility industry. But when the accountants saw Sam’s method, they rejected it, and on paper made it look like the Insull companies were losing money instead of making money. More negative headlines, even though ComEd and most of the rest of the empire was profitable and continued to pay dividends throughout the Great Depression.

In April of 1932, Sam had arranged for a $10 million loan to Middle West. The New York bankers stepped in and made sure the loan was not made. On June 4, 1932, the bankers, working through Sam’s old friends on his board of directors, demanded his resignation. Gladys urged him to fight on, but Sam decided otherwise, resigning every title in his more than sixty corporations two days later. The board promised him a pension, a promise they later reneged on. $3 billion in assets had been forfeited for lack of a $10 million loan.

Samuel Insull was increasingly reviled by the press and politicians on both sides of the aisle. At Depression-level prices, investors had lost hundreds of millions on their investments in his companies. The newspapers were full of stories of evil businessmen trying to control politics. Other stories claimed his empire had always been a house of cards. Sam was personally $16 million in debt with no assets left to his name, which was quickly becoming mud. Gladys had a million dollars in assets in her name, but Sam twisted her arm to also surrender those assets to his creditors, since he did not want anyone claiming he held anything back.

Exhausted, with tattered nerves, Sam decided to leave the frenzied situation in Chicago until people calmed down and came to their senses. He and Gladys moved to Paris.

The Storm

The year 1932 was also an election year, with Herbert Hoover and the Republicans headed for a resounding defeat. At first, Sam’s many friends in both parties refused to use him as a scapegoat or campaign issue. But that didn’t last as November’s elections grew closer.

On September 15, 1932, John Swanson, the Cook County State’s Attorney, told his son-in-law, “You know, Sam Insull is the greatest man I’ve ever known. No one has ever done more for Chicago, and I know he has never taken a dishonest dollar, but Insull knows politics, and he will understand. But I’ve got to do it.” Two hours later, Swanson held a press conference and announced he was launching an investigation into the “Insull scandals.”

Politicians then competed in vilifying Insull. Presidential candidate Franklin Roosevelt rewrote his speeches to include Insull, promising to “get him.”

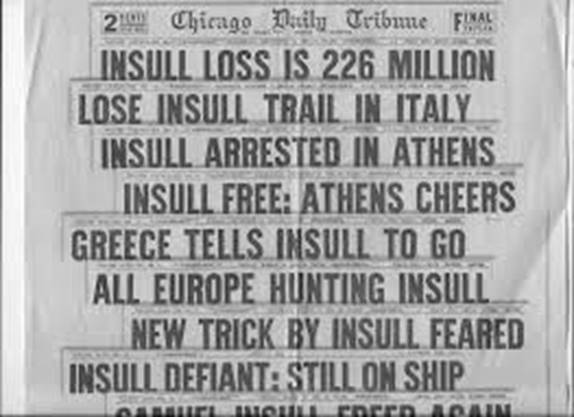

On October 4, 1932, a grand jury indicted Sam Insull and his brother, Martin, for embezzlement and larceny.

Convinced that a political lynching was underway, Sam decided not to return to Chicago until the climate improved. He also feared assassination, and later ducked an assassin’s bullet. He told reporters he would gladly return to America if he was assured of a fair trial, not a political circus. With less than $3,000 to his name, he traveled to Italy and then to Greece, which had no extradition treaty with the United States. His former employees wired him money to live on. Gladys received death threats and a note saying, “You can get ready to buy a cemetery lot as the gang will send you your crooked boys head” and calling the Insulls “Yellow Jews.” (The Insulls were not Jewish.)

In the spring and summer of 1933, he and seventeen others, including his son, were indicted for mail fraud and violating the bankruptcy act. That October, President Roosevelt asked Mussolini to capture Insull in Italy, but Sam had already moved on to Greece. In their rush to get Insull, the Senate quickly ratified an extradition treaty with Greece. But the treaty required that a Greek court find Insull guilty first. Despite the US government sending top lawyers to Greece to argue the case in repeated trials, the Greeks never found sufficient evidence to extradite Sam.

Sam kept busy by helping the Greeks plan a nationwide electrical system. He might have become the minister of Electric Power in the Greek cabinet had one of his friends won the prime ministry, but the man lost by seven hundred votes.

Congress rushed through a bill authorizing the government to arrest Insull in almost any country in the world. Desperate to capture the “outlaw,” the US government told the Greek American Merchants Association that the government would block them from sending much-needed funds back to the home country unless those Greek Americans pressured the Greek government to grab Insull. The Greek government refused but ordered Insull to leave Greece. He was able borrow enough money to charter a ship with the intention of sailing around the Mediterranean but was kidnapped off the boat by Turkish police when the ship stopped in Istanbul for provisions.

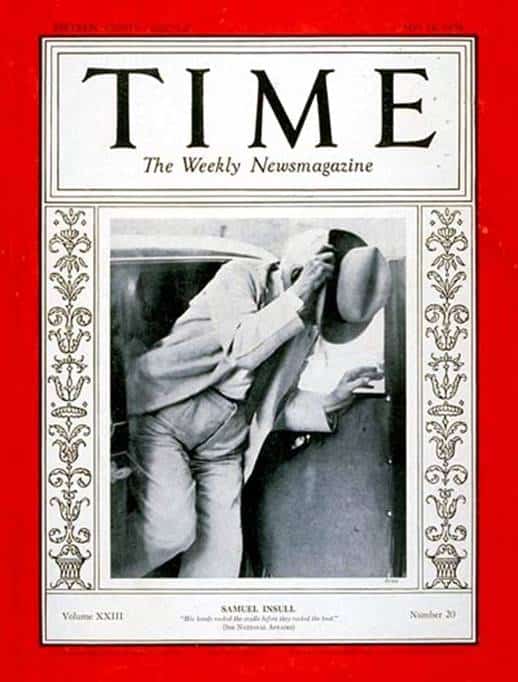

In May 1934, Sam Insull returned to America under heavy guard. His moods swung on the long trip across the Atlantic. At one moment, he was telling his State Department escort the stories of his life and accomplishments. The next minute, he seemed a shell of a man, uncontrollably weeping. Twice he thought of suicide, but the escort talked him out of it.

As they approached New York, he told his escort, “If two men had walked down Fifth Avenue a year ago (when Prohibition was still in effect), and one of them had a pint of whiskey in his pocket and the other had a hundred dollars in gold coin, the one with the whiskey would have been called a criminal, and the one with the gold an honest citizen. If these two men had, like Rip Van Winkle, slept for a year and again walked down Fifth Avenue, the man with the whiskey would be called an honest citizen and the one with the gold coin a criminal. I find myself somewhat in this sort of situation.”

The Trials

In Chicago, Sam was thrown in jail alongside murderers. His lawyers negotiated bail of $100,000 and came up with the money. But when they went to get him released, the prosecutors reneged on the deal and demanded $200,000, which the lawyers were ready to pay. But Sam Insull refused, never having yielded to extortion or blackmail. He was finally released, awaiting his October 1934 trial for mail fraud. He used the summer to write his memoirs in an effort to set the record straight.

As the trial began on October 2, 1934, government prosecutors made the case that Insull had used the mails to unload worthless securities on an unsuspecting public. The fifty-page, twenty-five-count indictment listed seventeen defendants. The lead prosecutor, future Illinois Governor Dwight Green, said Insull and his associates had run “a simple conspiracy to swindle, cheat, and defraud the public.”

Every day of the trial, every witness, and every move by the prosecution and the defense made headlines in newspapers from London to Buenos Aires. Millions of readers were glued to the dramatic story.

Sam’s (and his son’s) defense team was led by former Illinois Supreme Court Judge Floyd Thompson. Thompson was described as having a folksy, farm-boy persuasiveness combined with an actor’s sense of rhythm and pace.

Thompson thought that Sam should make his own case on the stand; that people needed to hear his side of the story. He intended to ask the jury, “Why would this man, after a life of accomplishment and fifty years of accolades, turn to crime in his late sixties?” Sam’s memoirs were helpful, but by September, right before the trial, his mind began to fail, his memory grew hazy. Thompson grew concerned that the old man might stumble on the stand.

The government brought all their “big weapons” to bear on the case, which drug on for weeks of testimony: eighty-three witnesses for the prosecution in the first week alone. Scores of top investigators from the Justice and Treasury Departments in Washington scoured the records of the Insull companies. The best special prosecutor in the nation, Leslie Salter, joined the prosecution team. Salter had won 98 convictions in 101 trials of Prohibition violators, at a time when most such “criminals” won their cases.

One prosecution witness, a disgruntled former comptroller at bond brokerage firm Halsey, Stuart, testified for three days about the “worthless” securities his firm sold. But when he was forced to admit that he and all the other top Halsey, Stuart executives bought those securities for themselves, his testimony damaged the prosecution’s case.

Their case was further damaged when the prosecutors first learned that Sam Insull had given away as much as he earned in most years in the 1920s.

On November 1, ten days before his seventy-fifth birthday, Samuel Insull took the stand. This time, his mind was as sharp as ever. He told the full story of his coming to America, working for Edison, and what he did for Chicago and for the utility industry. Everyone in the court room was captivated. When the prosecution team objected to his storytelling, the judge told them to sit down; the jury frowned at them.

Prosecutor Leslie Salter happened into the restroom at the same time as Samuel Insull, Jr. He had a puzzled look on his face, and said to Junior, “Say, you fellows were legitimate businessmen.” To which Junior replied, “That’s what we’ve been trying to tell you.”

When the other defendants in the case called up friends as character witnesses, Sam Insull was too proud to do that. He would stand on his own and not ask favors of old friends which might also draw them into the mud.

On November 4, the jury retired to decide the case. They reached a verdict of “innocent” (on all charges, all defendants) in five minutes. However, to make sure no one thought they had been bought, they waited two hours to return to the courtroom to announce their verdict.

March and June of 1935 brought two more trials on the other charges against Insull and his associates. Again, all were acquitted of all charges.

For all his hours of hard work and contributions to society, Samuel Insull’s reward was that he was allowed to not die in prison.

The End of the Story

The political wranglings described in the preceding paragraphs resulted in many new laws and policies. The Securities and Exchange Commission (SEC) was created to regulate the sale of stocks. Accounting systems and corporate reporting were standardized. Utility holding companies were banned, with the FTC keeping a watchful eye on the industry. Senator Norris succeeded in getting the Tennessee Valley Authority (TVA) publicly controlled power utility that he wanted. Insull’s impact continued worldwide: the United Kingdom carried out his plans for a government-owned electric grid.

Investors who held onto their Insull securities generally turned out okay. While some companies were stronger than others, when the Depression finally ended and stocks rebounded, the total losses on all Insull securities were about 24 percent of the amount invested. None of the companies went bankrupt.

The strongest company, Commonwealth Edison, never missed a dividend. Today the company has morphed into Exelon, America’s largest electric company and the largest non-government operator of nuclear power plants in the world. Exelon has over ten million customers and generates revenues exceeding $30 billion per year.

Sam made at least one more run at entrepreneurship, organizing a chain of Indiana radio stations, but the effort failed. After that, Gladys and Sam felt they could not stay in Chicago, where many still hated the man. They moved to Paris.

Sam’s wealth had fallen from a peak of $150 million to a mere $10,000.

On July 16, 1938, seventy-eight-year-old Samuel Insull died of a heart attack while awaiting a train in a Paris Metro (subway) station. Since he had no wallet and no money, the newspapers declared that he had died a pauper. Yet everyone who knew Sam knew he went nowhere without his wallet, usually with perhaps $1,000 in cash in it. So Sam’s body had been robbed. Biographer Forrest McDonald closes his story with the line, “And so, in his death, as in his life, Samuel Insull was robbed, and nobody got the story straight.”

The Lord gave, and the Lord hath taken away – Job 1:21

Gary Hoover

Sources: This story is based on the only full biography of Insull, Insull: The Rise and Fall of a Billionaire Utility Tycoon, by Forrest McDonald (1962). While McDonald’s book is clearly favorable to Insull and critical of his “enemies,” the book was deeply researched, including hundreds of interviews with people who knew Sam Insull personally. Controversies about Insull continue to this day. Another book about Insull is The Merchant of Power: Sam Insull, Thomas Edison, and the Creation of the Modern Metropolis, by John Wasik (2006). Also of interest is The Electric City: Energy and the Growth of the Chicago Area, 1880-1930, by Harold Platt (1991). For those with a deeper interest, The Memoirs of Samuel Insull: An Autobiography is also worthwhile. Francis Busch’s Guilty or Not Guilty? (1952) contains the most details on the Insull trials as well as other highly publicized court cases of the era.